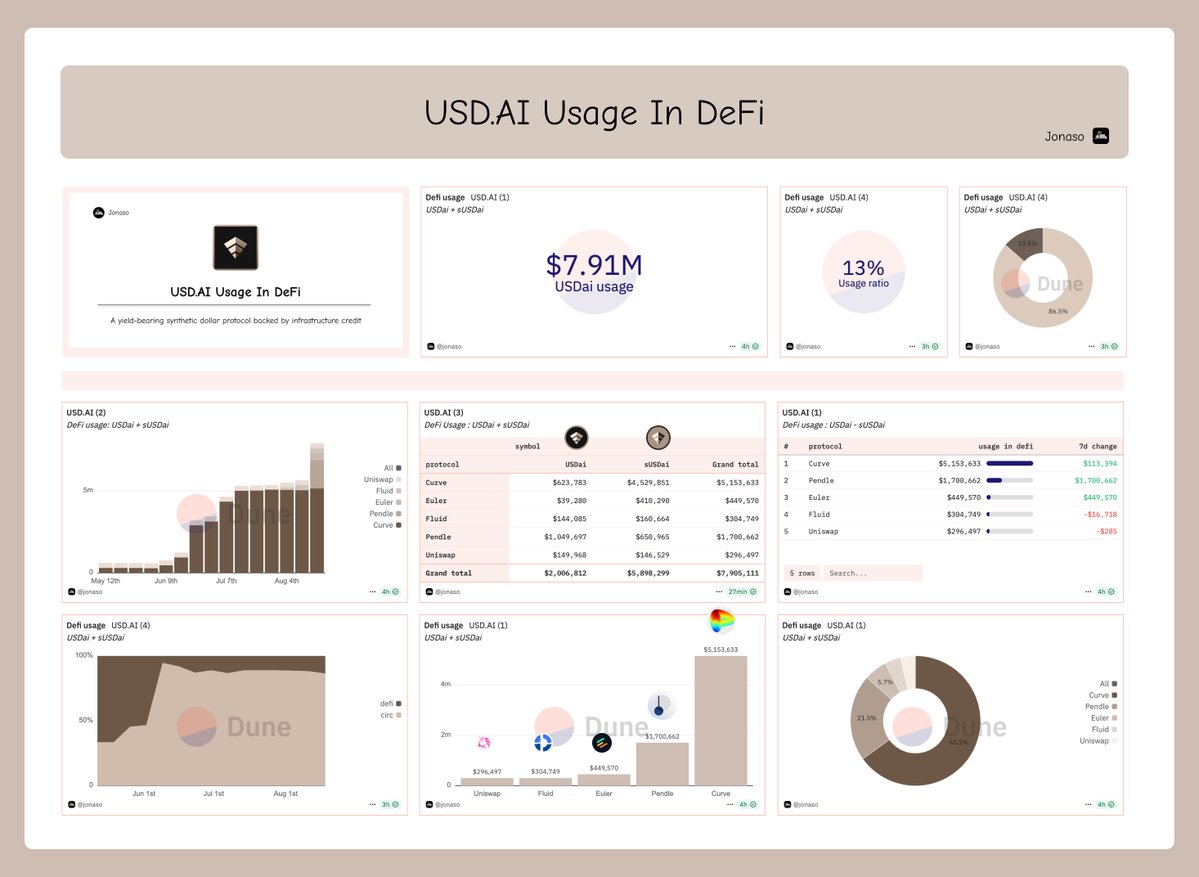

My first Dune dashboard showcasing USDai usage in Arbitrum DeFi

Arbitrum Enters the YBS Game with @USDai_Official ➞ Onchain Credit Backed by AI Infrastructure

A new standard is emerging on @arbitrum ➞ Called $USDai, backed by assets like GPUs, it’s a yield-bearing stablecoin that fuels the next wave of InfraFi

It’s growing fast ➞ TVL jumped 58x in just two months: $1M → $58M

Nearly $8M in $USDai and $sUSDai are already deployed across DeFi

Where are USDai and sUSDai used?

➥ DEX Liquidity: @CurveFinance is currently the deepest pool for USDai

- USDai/sUSDai pool with over $5M in liquidity

- USDai/USDC pool is live, offering 4% APY

➥ Yield Strategies: @pendle_fi is still the top destination to optimize YBS yields

- PT USDai: 13.24% APY

- PT sUSDai: 17.24% APY

- 1 YT USDai gives 825x points

➥ Money Market: @eulerfinance opens the gates for leveraged AI credit strategies

- 23% ROE with sUSDai/USDC vault

- Supply sUSDai directly for 6% APY

USDai is the first of its kind ↓

- A DeFi-native stablecoin that captures real-world compute demand

- Core collateral for the AI economy onchain

25.71K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.